You must provide a copy of your Forms W-2 to the authorized IRS e-file provider before the provider sends the electronic return to the IRS. CP204 is a form for submission of estimated tax payable.

.png)

How To Check Your Income Tax Number

Trust bodies cooperative and Limited Liability Partners LLP are required to submit the CP204 form via e-Filing starting from year 2019.

. You dont need to send your Forms W-2 to the IRS and should keep them in a safe place with a copy of your tax return. Scroll to the bottom and click. Peak Hours at LHDNM Customer Service Centre 1-800-88-5436 LHDN.

Kindly contact the LHDN Branch that handles your file or Hasil Care Line toll-free 03-8911 1000. You need to submit your annual income via e-Filing or manually if you are not subject to the MTD as the Final Tax. Heres how you can apply for your PIN number online.

Payment Code Tax Category. The adjustment form for CP204 is called the CP204A form. Mondays to Fridays 800 am to 500 pm.

Click on Application and then e-Filing PIN Number Application at the left menu. After submitting your tax returns all you require is your Tax File number and amount to make. Please provide us with your full name income tax number and telephone numbers when you contact us through phone.

CONTACT DETAILS email protected OPERATING HOURS. Get 100 correct PCB calculations every time. You are advised to contact LHDN to find out your payment code.

E-Filing Service Counter. Passport number for non -Malaysian citizens Bank account name and number. This accurate payroll software is also known to help small to large companies avoid penalties from filing incorrect taxes.

After filing retain a copy of the forms for your records. For employees working in Malaysia registered entities be it local or foreigner work pass holders it is a norm to see in their monthly pay slip indications of monthly contribution deducted from their monthly salary as well as their employersThis article will explain in detail what these monthly deductions entails to and why they are required by the Employment Act 1955. Number 1 Hybrid Cloud.

Book An Appointment Online Demo Be Our Partner. CP38 is an additional tax deduction order issued by LHDN specifically to an employer. Actpay is approved by LHDN.

The submission of Return Form RF for Year Assessment 2021 via e-Filing for Forms E BE B M BT MT P TF and TP Forms commences on March 1st 2022. The employer is obligated to inform the assessment branch of IRBM by filing and submitting a CP 22 form within one month from the date of commencement of an employment. March begins tax filing season.

Filing a tax assessment in Malaysia is compulsory under section 107C. Select the Form CP55D and complete the pdf form. This CP38 form regulation requires employers to make additional deductions in monthly.

File and Submit LHDN E Filing 2021 Conveniently 07122020. This form is used to amend or revise the amount of the estimated tax payable declared in CP204. You can get it from the nearest LHDN branch office or apply online via the LHDN Customer Feedback website.

Steps To Apply E Pin Online L Co

Update Your Latest Mailing Address To Lhdn With E Kemaskini L Co

Understanding Lhdn Form Ea Form E And Form Cp8d

Calcol Management Services Form Cp55d Attached As Per Follow For New Application Of E Pin Http Lampiran1 Hasil Gov My Pdf Pdfborang Cp55d17032020 Pdf Facebook

Update Your Latest Mailing Address To Lhdn With E Kemaskini L Co

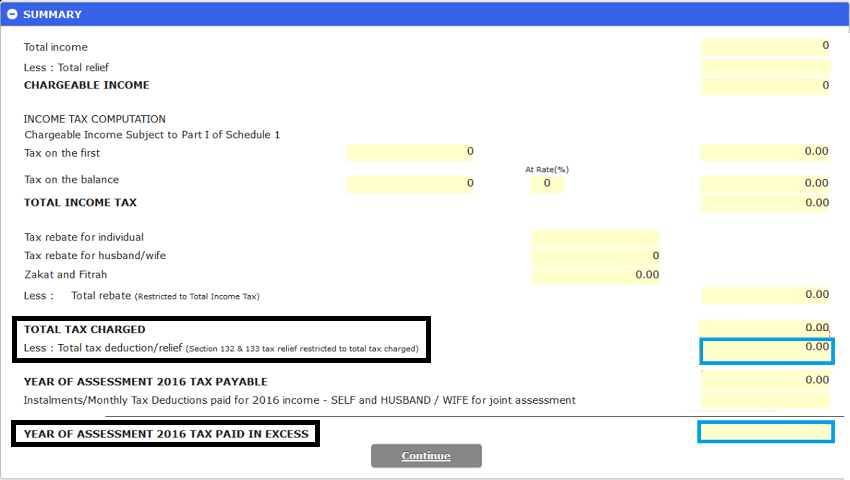

A Step By Step Guide To File Income Tax Online

Ctos Lhdn E Filing Guide For Clueless Employees

Tarikh Akhir Hantar Borang Cukai Efilling 2019 Periodic Table Shopping Screenshot

How To Request Your Malaysia Tax E Pin Online That Travel Itch